About

The SRS and What We Collect

Organization

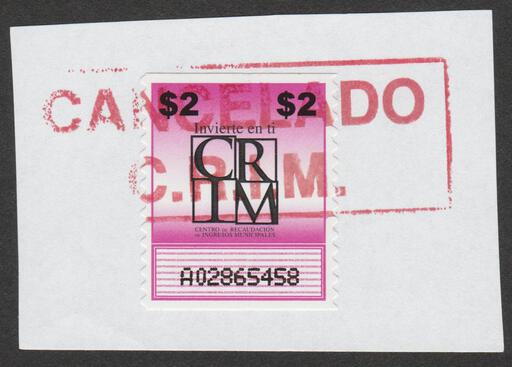

The State Revenue Society (“SRS”) promotes and encourages the study and collection of revenue stamps of the states, possessions, districts, territories, and other entities of the United States and their subdivisions (“state revenues”) and related materials.

For more on how the SRS is organized, read our constitution and bylaws.

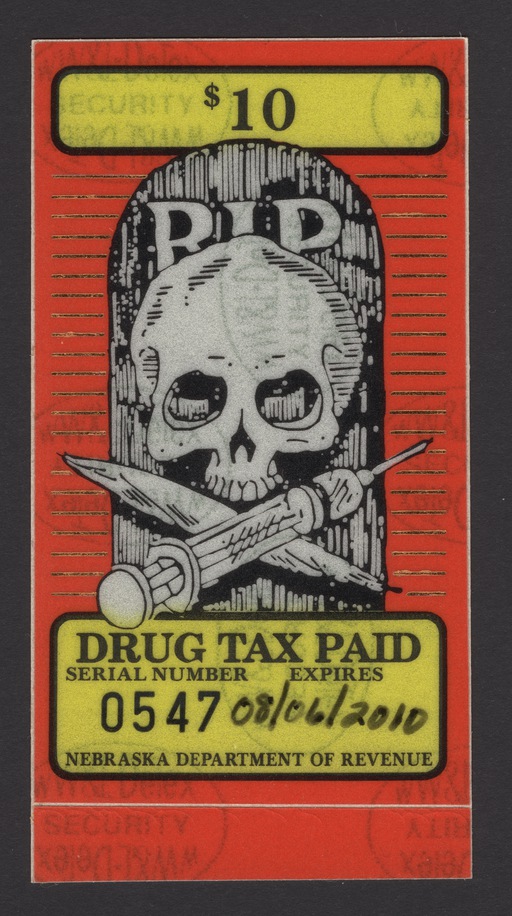

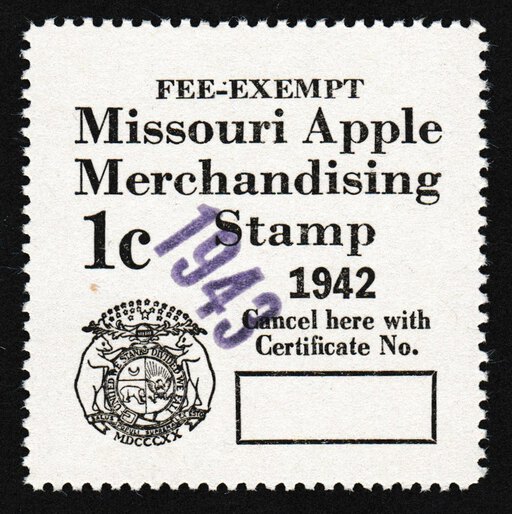

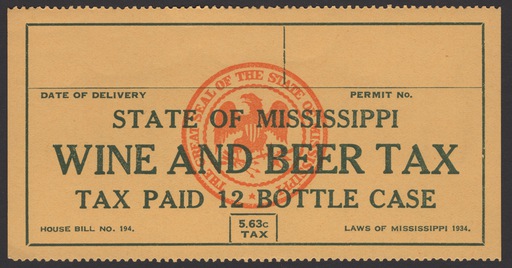

Revenue Stamps

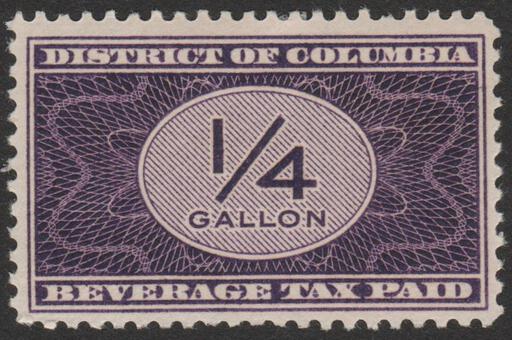

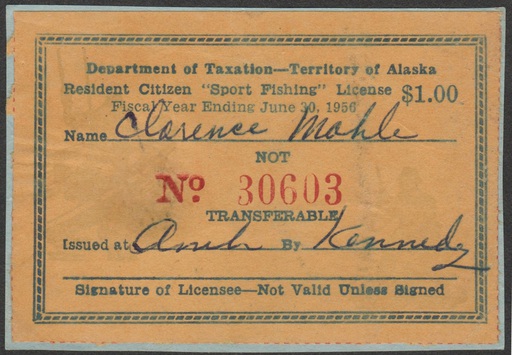

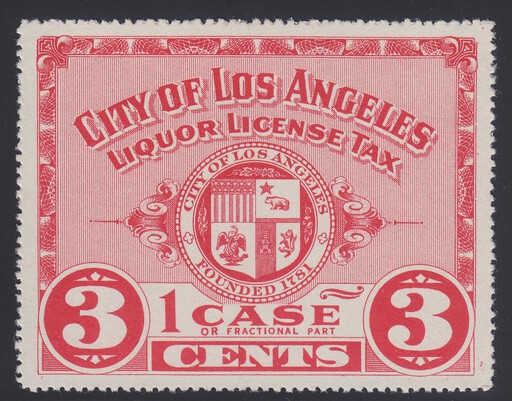

Unlike postage stamps, which prepay the costs to mail something, revenue stamps show that a government tax has been paid. Revenue stamps are sometimes called “tax stamps”, “fiscal stamps”, or simply, “revenues”.

Revenue stamps have been issued for centuries. In fact, revenue stamps predate postage stamps!

A revenue stamp has two essential components:

- Legal Authority

- Every revenue stamp can be traced to a law (e.g., statute, regulation, or ordinance).

- Governmental Purpose

- Revenue stamps must have some governmental purpose, usually fiscal. A revenue stamp could: All of the above examples are state revenues.

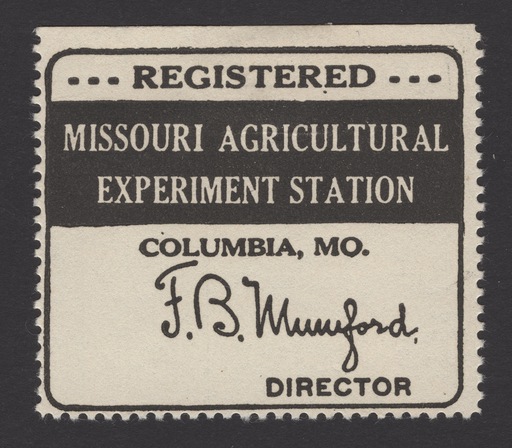

State Revenues

State revenues are revenue stamps issued by U.S. states. They are what the State Revenue Society collects and studies.

State revenues have a rich history. They can be traced back to revenue-embossed paper printed by American colonies, and continue to be used today. They are perhaps most commonly seen by non-collectors on cigarette boxes.

For an overview of state revenues, check out Ed Kettenbrink’s presentation Welcome to the Wonderful World of State Revenue Stamps. For a thorough introduction to state revenues, read Scott Troutman’s State Revenue Stamps of the USA (as published in the The Revenue Journal).

The SRS includes in its definition of “state revenue” any revenue stamp issued by a government of the United States that is not the federal government itself. These include the following entities of the United States: